The Low Return From Shorting MSTR

MSTR has been on a general downtrend since November 20, 2024. Has it been profitable to short?

MicroStrategy, now known as Strategy, has been buying Bitcoin for years. It reached its highest closing price on November 20 at $473.83 per share. A natural question arises: why not short MSTR? How would a short strategy have performed since that time?

To explore this, I’ll use put options rather than shorting the stock directly. One reason is that calculating the cost of shorting is more complex, as it depends on the interest rates used in equity lending. Additionally, put options are easier to track over time since their prices are reported daily. Finally, I find put options to be a more effective instrument because the potential loss is limited and known in advance—unlike shorting, where the loss can, in theory, be unlimited.

As a baseline, note that the price of MSTR on November 20 was $473.83, while on March 12, 2025, it had fallen to $262.55—a decline of 44.59%. So surely a put option would offer a high return, right?

Let’s start by considering a long-term put. Suppose a short seller was uncertain when MSTR would decline and purchased a put option with a $500 strike price on November 20, 2024, expiring 13 months later on December 19, 2025. This option yielded a return of 4%. That’s because it had an ask price of $249.80 on November 20 and a bid price of $259.90 on March 12. Despite the significant decline in MSTR’s stock price over that period, the long-term put returned little.

You might think the low return is due to the long expiration period. And you’d be right—options with shorter expirations offer higher returns if the underlying stock moves in the right direction, making the option more in the money. But what expiration date should we choose to maximize returns?

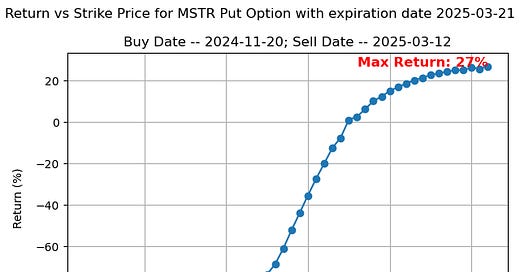

Let’s fix the expiration date at March 21, 2025. Our goal is to find the return from buying a put option on November 20, 2024, when MSTR closed at its peak. But which strike price should we select? There are many, even for the March 21 expiration.

To answer this, I downloaded the bid and ask prices for all MSTR put options with a buy date of November 20, 2024, a sell date of March 12, 2025, and an expiration date of March 21, 2025. I then calculated the return for each option, assuming a purchase at the ask price and a sale at the bid price. This produced a graph of returns by strike price, shown below:

The maximum return came from the put option with a $520 strike price, yielding a 27% return. While that may seem high, it's surprisingly low considering the stock itself declined by 44.59% percent over the same period.

Comparison with Tesla

To understand why the return from shorting MSTR is relatively low, let's compare it to Tesla. Tesla closed at $428.22 on January 15, 2025, and three weeks later, it closed at $328.50 on February 11, 2025—a decline of 23.29%. A Tesla put option with a strike price of $370 and an expiration date of February 14, 2025, would have returned 300%.

Tesla declined even further to $281.95 on February 27, 2025. A Tesla put option with a strike price of $325 and an expiration date of February 28, 2025—purchased on January 15 and sold on February 27—would have generated a 779% return. A put option with a strike price of $260, expiring on March 21, 2025. Buying this option for $1.89 on January 15, when Tesla closed at $428.22, and selling it for $40.80 on March 10, when Tesla traded at $222.15, would have yielded a return of 2,059%. Granted, this scenario involves perfectly timing both the high and low. However, the point remains: even with perfect timing on MSTR, you wouldn't come close to achieving the kinds of returns seen from shorting Tesla.

So what’s going on? Ultimately, option prices depend on many factors, but most importantly, the stock price and its volatility. When MSTR reached its global maximum on November 20, 2024, its volatility was at an all-time high—alongside its price. That elevated volatility drove up the price of the options. This makes sense, as option pricing reflects risk; it's essentially the cost of insurance. Market makers must account for the risk of large payouts if options end up deep in the money. While Tesla also hit an all-time high in January, it reached that level more gradually than MSTR, resulting in lower relative volatility.

The key takeaway is that volatility plays a crucial role—not just the stock price itself. Because Bitcoin is highly volatile, and MSTR even more so, that volatility impacts option returns in subtle but significant ways, setting them apart from other securities and assets.