A few years back, Giovanni Santostasi released a power law model to fit Bitcoin's price behavior over time. The basic idea is that power laws are useful for describing a wide variety of phenomena in nature and science. Formerly, the power law fitted to Bitcoin is a simple equation

Here t is time, t_0 is initial time, A is a scaling factor, and n is an exponent. Put simply, the price of Bitcoin is a function of the amount of time that has passed since its inception. This relationship can be seen most visually by taking the logarithm of both sides. If you do that, you will arrive at

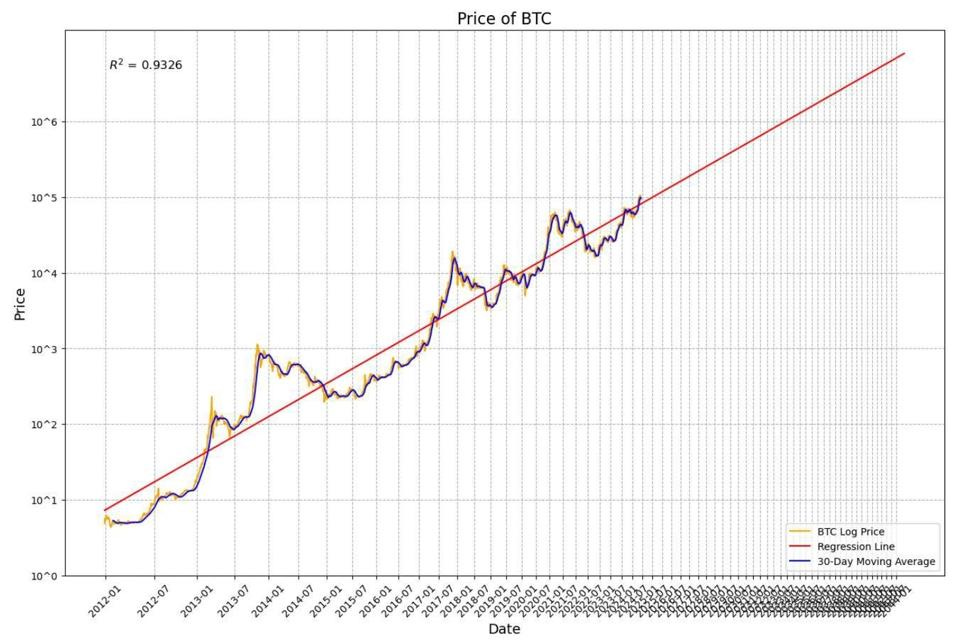

Then, you can fit a linear regression to log price against log time. Doing that will generate the following graph.

My data runs from 2011, and you'll see that there is a very clear linear trend in the log-log space. This differs from my previous analysis, where I had used and plotted log price against time. Here, I'm plotting the log price against log time.

The full article on the power law theory by its author is a deeper exposition of why power laws work in nature. Most of that essay is worth reading, though I will disagree on one point. The author claims that the power law has nothing to do with scarcity, since it is a statistical fit to a price chart. However, scarcity is the foundation of Bitcoin's value proposition and is exactly why new buyers continue to enter the market.

But why?

Keep reading with a 7-day free trial

Subscribe to Principles of Bitcoin to keep reading this post and get 7 days of free access to the full post archives.