How Much is Bitcoin Correlated with the Market?

Let's examine the statistical correlation between BTC-USD and SPY over different rolling windows in 2024.

There are several narratives behind Bitcoin, and one of them is its lack of correlation with the market. For example, some famous investors in the past have recommended holding bitcoin because of its lack of correlation with traditional investments. Let's formally examine this with data from 2024.

I define the market as the S&P 500. This is not the entire universe of stocks, and not even the entire universe of US stocks, but the S&P 500 has become the benchmark for the financial industry. Part of the reason is that it is valve-weighted, which means that it rebalances towards the highest valuation companies. This means that SPY is inherently somewhat trend-following, as it brings the higher growth companies into the index over time. For example, as Palantir (PLTR) grew in market cap, it joined the S&P 500 and, in fact, led the S&P 500 last year. And full disclosure, any analysis of the S&P 500 will include an inherent bias to the Mag 7.

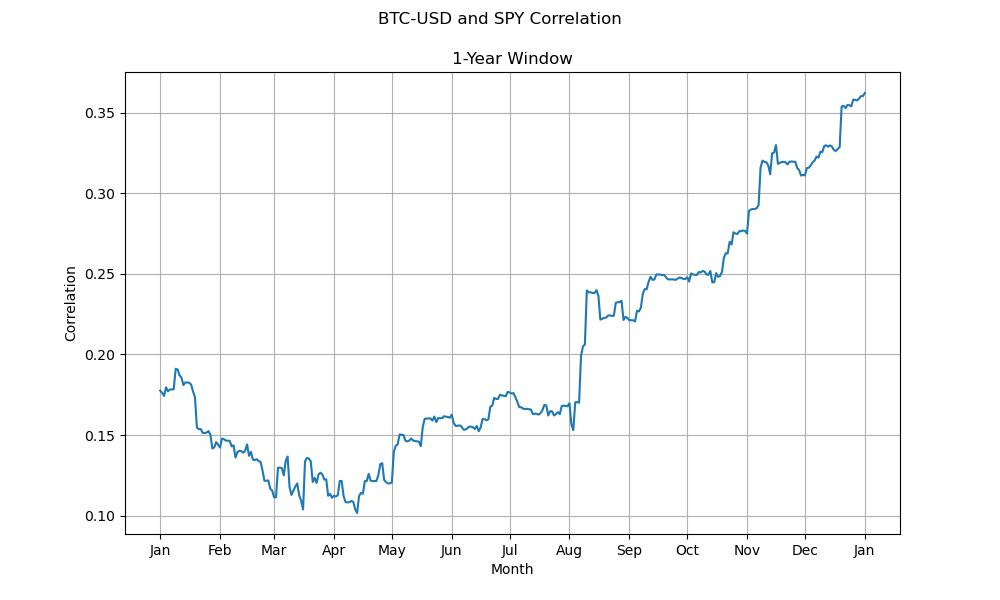

I examine the statistical correlation between BTC-USD and SPY over a rolling window. First consider the rolling one-year window. For example, a correlation of 0.32 on December 1, 2024, means that the statistical correlation between BTC-USD and SPY from December 1, 2023, to December 1, 2024 was 0.32. Using this metric, we can plot the correlation over the one-year window as:

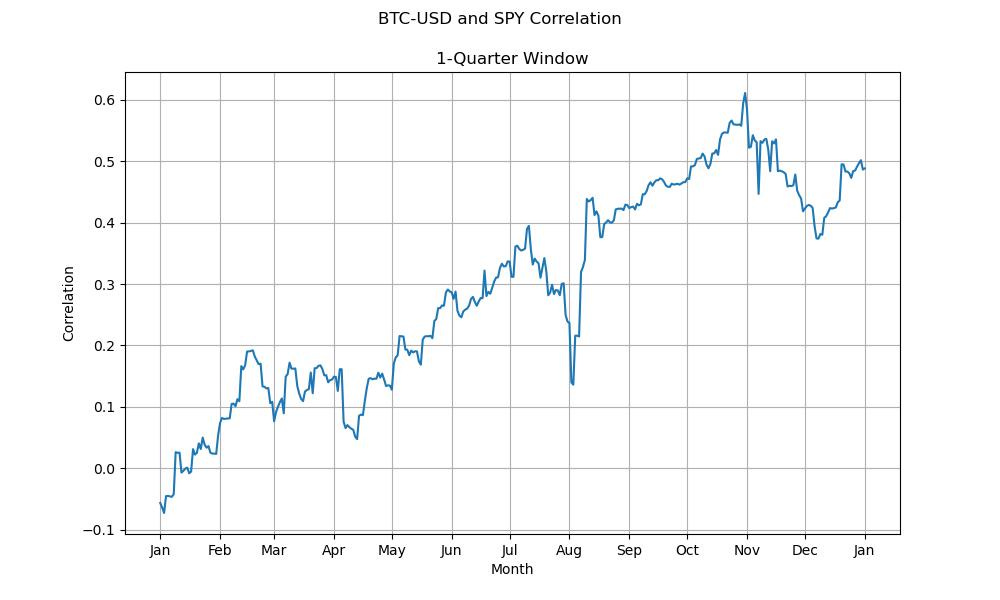

Notice that the correlation dipped to a low of 0.1 right before the halving last May and has steadily risen since then. The correlation ended at a high point above 0.35 at the end of the year. So Bitcoin is positively, though not perfectly, correlated with the market. Technically, anything above a correlation of zero is considered positively correlated, but the correlation over a year does not break 0.5. So we cannot say that it is close to perfectly correlated, but there is a definite trend that the correlation has increased. Now let's examine the correlation over a rolling one-quarter window. So I calculate the correlation just over the last three months for any day in 2024:

Now this trend is even more stark. Bitcoin even started the year uncorrelated with the market, where its correlation was actually negative. But it steadily rose throughout the year, peaking at over 0.6 in October. You can see the slight effect of the Trump election in November, where the correlation rose in the last month of the year. But there is a clear upward trend throughout the year.

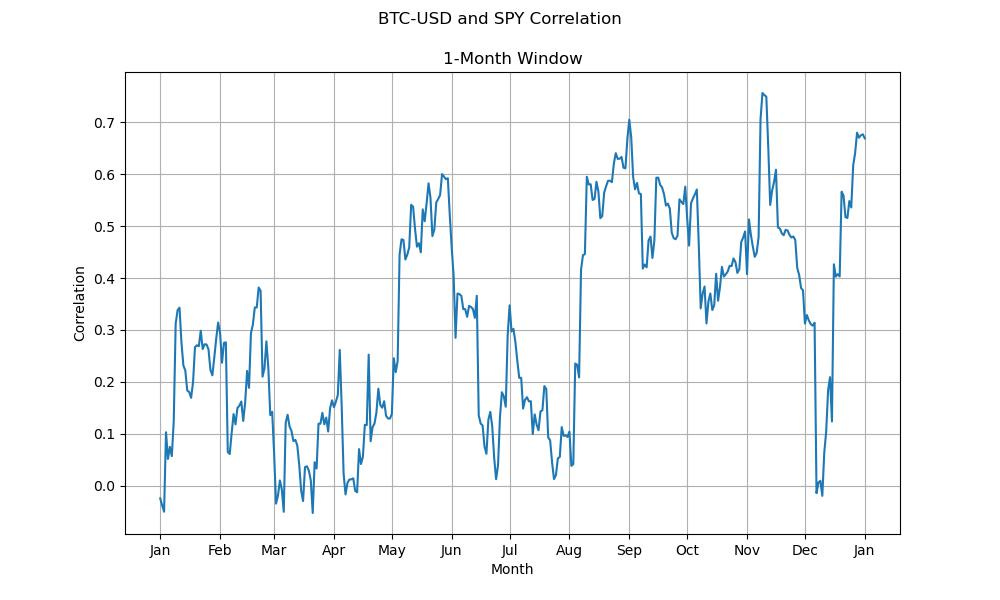

What about shorter horizons? Let's consider the correlation over a rolling one-month window. So for example, a correlation of 0.5 on June 1, 2024, gives the statistical correlation between BTC-USD and SPY from May 1, 2024 to June 1, 2024. Here's a graph of the rolling one-month window:

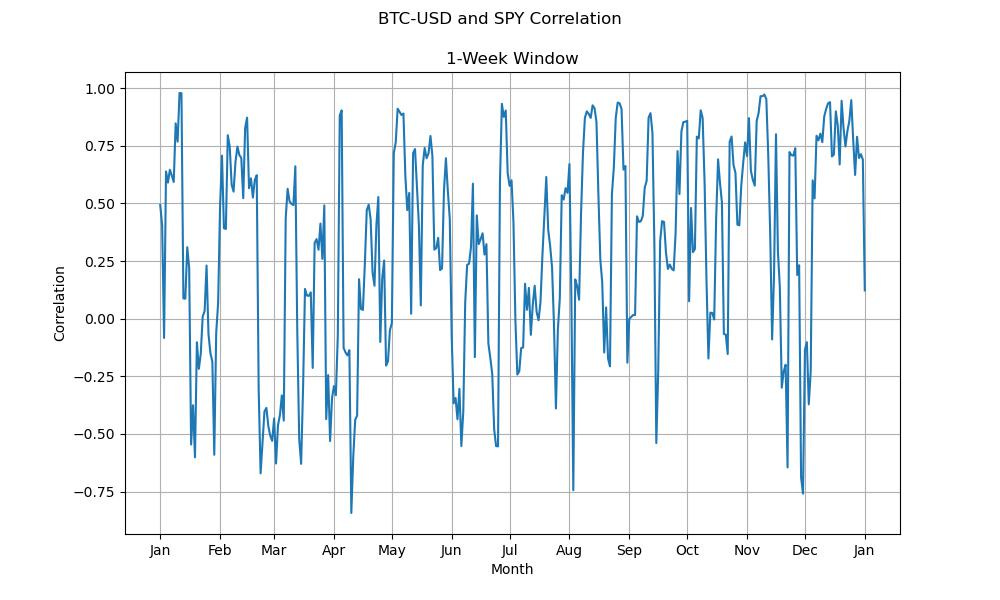

It's true that the correlation increased over the year, but the pattern is much less obvious. Moreover, the variation in correlation is much larger, ranging from an uncorrelated level of around 0 to a highly correlated level of 0.7. So, on a monthly horizon, it's less clear that there is a trend in the correlation between Bitcoin and the market. The most extreme version of this can be seen in the weekly rolling window:

Now you can see that at a weekly level, Bitcoin ranges from nearly completely uncorrelated with the market, with several weeks and days below a correlation of 0.5, to perfectly correlated with the market, with several days with a correlation almost of 1.0. But I would not read too much into this last graph. The weekly correlation simply reflects the high volatility of Bitcoin and likely the activity of traders.

The data at least presents the trend that correlation between Bitcoin and the market has increased over time, evidenced by the longer-term windows of one quarter and one year. This shows that as more capital flows into Bitcoin, Bitcoin itself moves in step with the market. So the forces that move the market as a whole, like supply shocks, changing interest rates, and broad economic growth, will move Bitcoin as well.

The bottom line is that Bitcoin is a higher risk, higher return asset, not a tool for diversification. It may increase returns as part of a market portfolio, but don’t expect it to decrease the portfolio’s volatility. Those are the facts.