A New Way to Value Bitcoin Treasury Companies

Market-to-Fair Book Value as an Alternative to mNAV

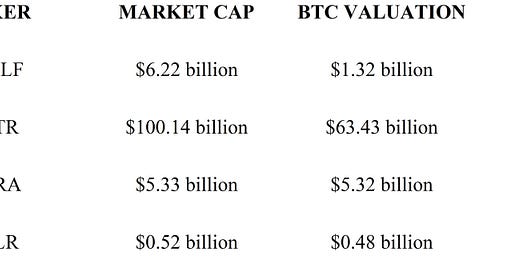

Strategy—formerly known as MicroStrategy—is the original Bitcoin treasury company. Michael Saylor famously announced that the company’s primary mission was to buy and hold bitcoin. Since then, several other companies have followed suit, including Semler Scientific, Marathon Digital Holdings, MetaPlanet, SmarterWeb, and others. In fact, new entrants continue to appear almost weekly. Some of these companies, like Marathon, have a substantial underlying operating business. Others, like XXI, are pure-play treasury companies. Still others, like Strategy, Semler, and MetaPlanet, operate small businesses that are dwarfed by their Bitcoin holdings.

So, what is the best way to value these companies?

Traditionally, investors have used mNAV—Market-to-Net Asset Value. Because most of these firms’ value is derived from their bitcoin holdings, the standard metric has been mNAV: the ratio of the company’s enterprise value to the value of its underlying Bitcoin. When mNAV is less than one, the company trades at a discount to the value of its Bitcoin. When mNAV is greater than one, it trades at a premium. There are several reasons a firm might trade at either a discount or a premium. For example, MicroStrategy traded at a discount during the last Bitcoin bear market, when its mNAV dropped below 0.8. Today, it trades at a premium, fueled by sustained interest from large institutional investors. Often, this premium reflects regulatory or geographic arbitrage.

Some investors cannot directly buy or hold Bitcoin. Bitcoin treasury companies offer these investors a proxy. For example, many mutual funds are restricted by their mandates to hold only publicly listed equities—and must hold them in large enough quantities to matter. That creates demand for companies like Strategy. In another case, countries like the United Kingdom prohibit Bitcoin in retirement accounts but allow public equities. These are just two reasons why MSTR might trade at a premium to their net asset value.

The conventional definition of mNAV is:

Keep reading with a 7-day free trial

Subscribe to Principles of Bitcoin to keep reading this post and get 7 days of free access to the full post archives.